Refinance A Construction Loan

Considering how low rates have gone I’ve started shopping around for a new 30 year fixed rate loan to refinance out of the original construction loan. Currently I’m finding rates in the 5.125% to 4.875% range for a 30 year fixed mortage with zero points.

The interesting part of all this is hearing all the new fees and regulations that have popped up over the last couple of years. As one banker put it to me today we are all paying a price for the sins of the past banking industry. There is a 0.25% fee being added to fixed mortgages by the fine folks at FannieMae (presumeably to cover insurance on loans). Banks are being much more strict on limits that require escrow accounts to cover taxes and insurance. And it’s very unlikely that you’ll be getting a mortgage without significant equity in your property.

Having said that I hope we can refinance our existing construction loan to a 30 year fixed mortgage in the coming months. Preferably somewhere around 4.75% with any luck!

Recent Posts

Framing Stick Nailer vs Coil Nailer

Which is Better a Stick Nailer or Coil Nailer? Framers have many choices in nailers…

How Many Roofing Nails Per Square of Shingles

Estimating How Many Nails for a New Roof When it comes to estimating materials for…

Composite / PVC Decking – Layout Tips & Advice

Composite / PVC Decking Layout Tips and Advice Composite and PVC decking have really changed…

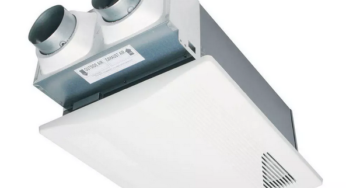

Benefits of an ERV System (Energy Recovery Ventilator)

Benefits of ERV Systems (Energy Recovery Ventilator) If you're building a new home or doing…

Vermiculite Attic Insulation Abatement

Vermiculite Attic Insulation If your home was built before 1990 there is a chance it…

Nuisance Tripping of AFCI (Arc Fault) Circuit Breakers

Arc Fault (AFCI) Circuit Breakers Tripping Often An arc-fault circuit interrupter (AFCI) or arc-fault detection…

View Comments

Very nice information. Thanks for this.

Regards,

Jane