Property Tax Abatement

Applying For A Property Tax Abatement

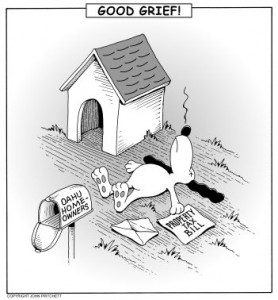

Benjamin Franklin once said “Certainty? In this world nothing is certain but death and taxes.” With the current financial pressures on all of us I thought I’d share my recent experience applying for a property tax abatement.

The National Tax Payers Union estimates that there could be as many as 60% of the taxable properties in this country over-assessed. With figures like that it’s easy to understand why many people apply for property tax abatements each year.

Tax Abatement Process

Each state and local government has different rules and regulations about how you actually apply for a tax abatement. However, with a little research and time it’s not overly complicated to apply for a property tax abatement. I suggest you take a trip to your local tax collector’s office and ask them for information about tax abatements. Pay particular attention to the deadlines and specific requirements of the necessary documents.

The important thing to realize when it comes to tax abatements is you need to rely on facts and not just complain that your taxes are too high. Most property taxes are abated using two approaches.

The first approach is the easiest; find and prove mistakes in the current tax assessor records about your property. Maybe the lot size is incorrect or they don’t have the correct square footage of your home but fixing that problem is very easy to prove.

The second approach involves a bit more research and requires that you prove an unequal assessment of your property compared to similar properties in your neighborhood. To do this you’ll need to spend some time as the local tax collector’s office searching through similar properties and taking notes that back-up your argument. Some towns and cities have that information available online so you can even do this from the comfort of your own home.

Once you’ve collected all the documents it’s as easy as filling out the required paperwork and submitting it along with back-up prior to the filing date. Again there are different procedures from this point depending on state and local laws. However, if you’re abatement is denied you can appeal it. This generally means you’ll need to take your argument to the State level either in court or with a board of appeals.

I recently applied for a property tax abatement. My argument was based on our land lot. Our lot is 1.39 acres in size. However, almost 31% of that land is restricted by easements for drainage and slope maintenance. Our properties assessed value was the same as other similar size properties in the neighborhood without easements. So my hope is that the abatement will be approved based on my knowledge that my land is not as valuable as land that has no restrictions.

Property Tax Abatement Update

My attempt to successfully abate my taxes was not successful. The town tax assessor did not agree with my argument about the lower value of land that has an easement. So at this point I could either accept the defeat or appeal the decision to the State. I haven’t made a decision yet but my gutt feeling is I’ll leave it alone for now.

Recent Posts

Framing Stick Nailer vs Coil Nailer

Which is Better a Stick Nailer or Coil Nailer? Framers have many choices in nailers…

How Many Roofing Nails Per Square of Shingles

Estimating How Many Nails for a New Roof When it comes to estimating materials for…

Composite / PVC Decking – Layout Tips & Advice

Composite / PVC Decking Layout Tips and Advice Composite and PVC decking have really changed…

Benefits of an ERV System (Energy Recovery Ventilator)

Benefits of ERV Systems (Energy Recovery Ventilator) If you're building a new home or doing…

Vermiculite Attic Insulation Abatement

Vermiculite Attic Insulation If your home was built before 1990 there is a chance it…

Nuisance Tripping of AFCI (Arc Fault) Circuit Breakers

Arc Fault (AFCI) Circuit Breakers Tripping Often An arc-fault circuit interrupter (AFCI) or arc-fault detection…